Balance of Payments Formula

According to the IMFs Balance of Payments Manual the balance of payment formula or identity is summarized as. To know more stay tuned to BYJUS.

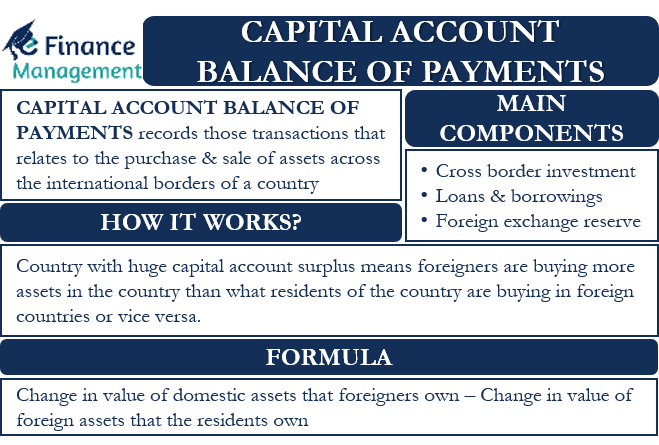

Capital Account Balance Of Payments Meaning Calculation Components

Interest that is not compounded you can use a formula that multiples principal rate and term.

. What is the Balance of Payments Formula. Again using the same logic we can calculate the total of the extra payments with. The formula for mortgage basically revolves around the fixed monthly payment and the amount of outstanding loan.

This function in all major spreadsheet programs Microsoft Excel Google Spreadsheet and Apple Numbers is known as PMT or the payment function. On the other hand a negative net exports figure indicates a trade deficit. The fixed monthly mortgage repayment calculation is based on the annuity formula Annuity Formula An annuity is the series of periodic payments to be received at the beginning of each period or the end of it.

An annuity is based. The most common terms for a fixed-rate mortgage are 30 years and 15 years. The number of years t you have to.

Calculate the number of payments. To get the number of monthly payments youre expected to make multiply the number. Simple interest means that interest payments are not compounded the interest is applied to the principal only.

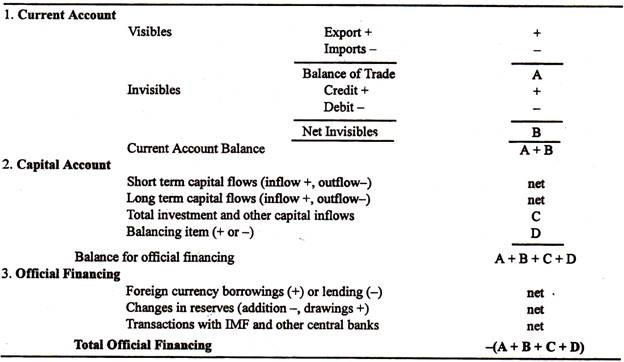

Typically the monthly payment remains the same and its divided among interest costs what your lender gets paid for the loan reducing your loan balance also known as paying off the loan principal and other expenses like property taxes. The above mentioned is the concept that is explained in detail about the Balance of Payments Surplus and Deficit for the class 12 students. Balance of Trade vs Balance of Payments.

A trade surplus or trade deficit reflects a countrys balance of trade which is essentially whether a country is a net exporter or importer and to what extent. The rest of the 200000 is comprised of the extra principal payments. An amortization schedule is a table detailing each periodic payment on an amortizing loan typically a mortgage as generated by an amortization calculator.

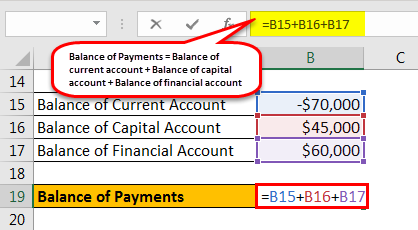

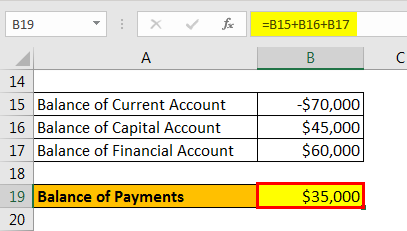

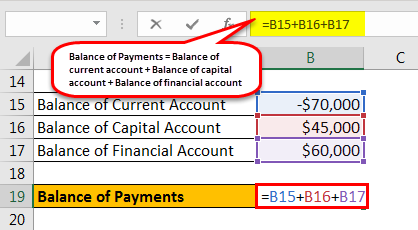

Balance of Payment Balance of Current Account Balance of Capital Account Balance of Financial Account. The balance sheet formula states that the sum of liabilities and owners equity is equal to the companys total assets. Amortization is the way loan payments are applied to certain types of loans.

What is Mortgage Formula. The loan amount P or principal which is the home-purchase price plus any other charges minus the down payment. In Canada the Government of Canada makes payments to less wealthy Canadian provinces to equalize the provinces fiscal capacitytheir ability to generate tax revenues.

Total Assets Liabilities Owners Equity. There are three formulas to calculate income from operations. Mcqs on Balance of Payments.

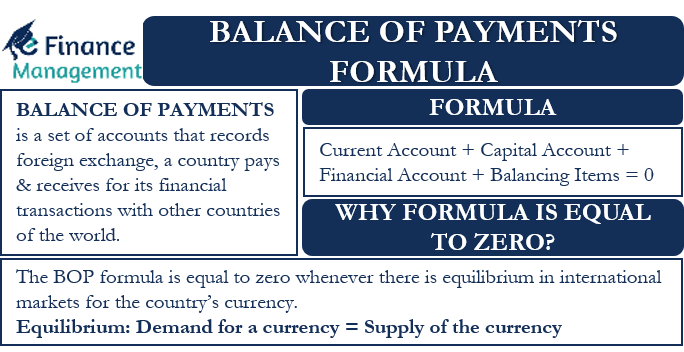

In 20092010 six provinces received 142 billion in equalization payments from the federal government. Current Account Financial Account Capital Account Balancing Item 0. Operating income Net Earnings Interest Expense Taxes.

Mortgage payments can be easily found using your chosen spreadsheet program. It combines information like your interest rate number of periods and principal to arrive at an. For UPSC related preparation materials visit the links given in the table below.

Understand the function used. SUMOFFSETBalanceRange0-1 which will give you 65100. How to Decrease ImportsIncrease Exports 1.

As a result its always a good idea to supplement this metric with other reports such as accounts receivable aging a report listing unpaid invoices and unused credit. This example assumes that 1000 is invested for 10 years at an annual interest rate of 5. Balance of Payments Formula.

Operating income Total Revenue Direct Costs Indirect Costs. Calculating the Total of the Extra Principal Payments. Using net income and retained earnings to calculate dividends paid.

Until the 2009-2010 fiscal year Ontario was the only province to have never received equalization. Candidates can know more about the UPSC Syllabus by visiting the linked article. To calculate simple interest in Excel ie.

Balance of Payments BOP. Formula for Operating income. That will show that your regular principal payments total to 134900.

As its name suggests this account records all capital transactions made between two countries. However its important to remember that the accounts receivable days formula is an overall measurement of accounts receivable rather than a customer-specific measurement. Here is the formula for calculating dividends.

Balance of payment has three components capital account current account and financial account. The balance of payments is a statement of all transactions made between entities in one country and the rest of the world over a defined period of time such as a. Read more prepaid expense Prepaid Expense Prepaid expenses refer to advance payments made by a firm whose benefits are acquired in the future.

Now that we have learnt the balance of payment meaning let us delve into the elements integrated into this statement. Amortization refers to the process of paying off a debt often from a loan or mortgage over time through regular payments. Operating income Gross Profit Operating Expenses Depreciation Amortization.

Annual net income minus net change in retained earnings dividends paid. The annual interest rate r on the loan but beware that this is not necessarily the APR because the mortgage is paid monthly not annually and that creates a slight difference between the APR and the interest rate. A portion of each payment is for interest while the remaining amount is applied towards the.

Balance Of Payments Formula Meaning Components Equation

Balance Of Payments Formula How To Calculate Bop Examples

Balance Of Payments Formula How To Calculate Bop Examples

Balance Of Payments Formula How To Calculate Bop Examples

Comments

Post a Comment